Xero Accounting

PSG Grant Available -

Xero Cloud Accounting Software

Want to get your company onboard a cloud accounting software? Look no further and get started to obtain a quote from us and we’ll take it from there. You could take a lot of time to do it, or let us handle it, pain-free. After putting things in order, we provide you free consultancy to continue to use the system, tailored to your company. Hit the button below to arrange a time with us for a free demo of the system!

We are certified Xero advisor certified and Silver Champion Partner of Xero.

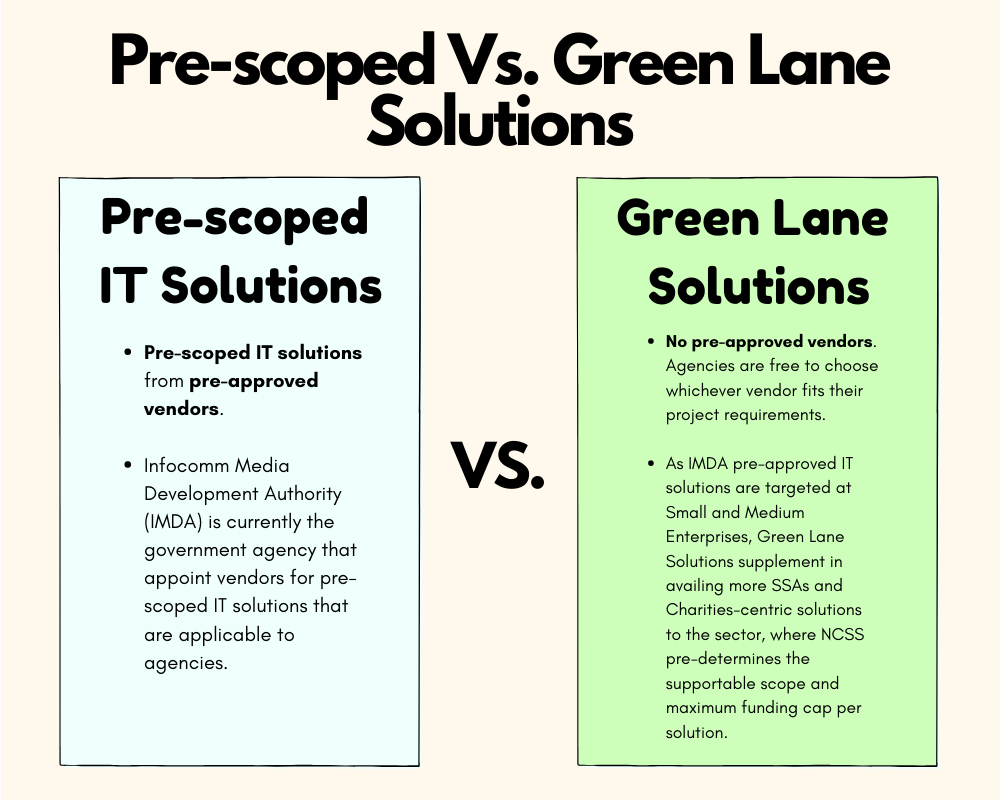

SMEs are eligible for up to 50% Productivity Solutions Grant (PSG) support for the adoption of Everyday Corporate Xero Cloud Accounting Software, a Pre-Approved Solution under the IMDA SMEs Go Digital programme.

Make use of your PSG grant to adopt an IT solution and/or equipment to enhance your business processes.

Speak to us for more information on grants and subsidies for SMEs in Singapore.

Are you a charity, social organisation, or a Social Service Agency (SSA)?

We offer solutions that can be covered by the grants

(Community Capability Trust (CCT) or Charities Capability Fund (CCF)

via the Green Lane Solutions.

Xero features

Pay bills +

Track and pay bills on time. And get a clear overview of accounts payable and cash flow.Claim expenses +

Simplify employee expense claims. Capture costs, submit, approve and reimburse claims, and view spending.Bank connections +

Connect your bank to Xero and set up bank feeds. Transactions flow securely straight into Xero each business day.Accept payments +

Accept payments online and get paid up to twice as fast by connecting to Stripe and other payment solutions.Track projects +

Quote, invoice and get paid for jobs, plus keep track of time, costs and project profitability within Xero.Pay runs +

Keep basic pay records online and do pay runs for a few employees using Xero, or else integrate a payroll app with Xero.Bank reconciliation +

Keep your financials in Xero up to date. Categorise your bank transactions each day using our suggested matches.Manage contacts +

Use Xero for contact management. See details of a customer’s or supplier’s sales, invoices and payments in one place.Capture data +

Get copies of original documents and key data into Xero automatically without manual data entry using Hubdoc.Files +

Use Xero as your online filing system. Manage and share documents, contracts, bills and receipts safely from anywhere.Reporting +

Track your finances with accurate accounting reports. And collaborate with your advisor online in real time.Inventory +

Keep track of what’s in stock with inventory software. Populate invoices and orders with items you buy and sell.GST returns +

Easily manage GST F5 returns and IAFs using IRAS-compliant software so it’s easy to stay on top of your tax obligations.Send invoices +

Work smarter with intuitive invoicing software. Send invoices from your phone or desktop as soon as the job is done.Multi-currency accounting +

Pay and get paid in over 160 currencies, with up-to-date exchange rates and instant currency conversions.Purchase orders +

Create and send purchase orders online with purchase order software. Keep track of orders and deliveries at every step.Quotes +

Create professional online quotes using Xero software or the app. Send quotes instantly from your phone or desktop.Analytics Plus +

See future cash flow, check financial health and track metrics. For extra features, upgrade to Analytics Plus.We are experts in App integration with Xero

We are experts in using app integration to help you in your organisational process workflow. Connect your shopfront (e-commerce, patient management, invoicing), HR system, Claims system, Banking platforms with your accounting system to eliminate duplication of data input and spend time on things that matter.

Need More?

Accounting Services $200/m

Corporate Income Tax $650/y

GST Preparation $150/m

Payroll $25/pax

Corporate Secretarial $650/y

Unaudited Financial Statements $650/y

Financial Reporting $200/m

Vendor Payment $100/m

FAQS

Why do businesses need accounting? Is accounting important? +

Accounting is a way to track your income and expenses, and also your company’s assets and liabilities – what people owe to you and what you owe to people, whether it is cash or services. A historical data of this, if done well, helps you to see the profitability of a particular project, department, product or your entire company. It is good data for future budgeting and cash management. Most importantly, you have an obligation to report your accounts to the these reports will enable the to calculate how much tax you owe and your exemptions.What are the accounting standards in Singapore? +

In Singapore, accounting standards are known as Singapore Financial Reporting Standard (SFRS) and are based on the International Financial Reporting Standard (IFRS). All Singapore listed companies must comply with the SFRS. For small entities, the SFRS for Small Entities, which is based on the IFRS for SMEs can be used. For charities, the Charities Accounting Standard can be used.Is it necessary to prepare financial statements? +

Yes, unless you are a private exempt company that is solvent. Even so, it is good practice to have financial statements. All Singapore incorporated companies are required to file financial statements (FS) with ACRA in XBRL format or PDF copy of FS authorised by directors, or both, except for Singapore exempt private companies that are solvent. If you own a sole proprietorship, partnership, limited liability partnership, or limited partnership, you are not required to file FS with ACRA.For more information click here.